Investing in real estate becomes most rewarding when you purchase an apartment complex due to its financial stability and earning potential. Multi-income streams produced by apartment complexes make them ideal investments for permanent holders. Investing in an apartment complex demands thorough market study and planning alongside research experience alongside market knowledge. This guide presents a systematic explanation about how to invest intelligently in apartment complexes.

Why Invest in an Apartment Complex?

Before jumping into the practical steps, let's briefly cover why apartment complexes are a great investment opportunity:

- Steady Cash Flow: Multiple rental units offer reliable monthly income.

- Appreciation Potential: Property values often increase over time, offering the potential for significant returns.

- Economies of Scale: Managing multiple units in one location can be more cost-effective than managing several single-family homes.

- Portfolio Diversification: Apartment complexes are a valuable addition to any investment portfolio.

Step 1: Define Your Investment Goals

Your first step should be to define your objectives from the new purchase. Your main objectives in this purchase determine whether you want rental income stability alongside equity growth or simply need a combination of both. Your goals define the specific apartment complex characteristics you need to seek.

Additionally, consider your risk tolerance and financial situation. Ask yourself key questions like:

- How much money am I comfortable investing?

- Am I looking for a property that needs renovation or one that is turnkey?

- Do I want to manage the property myself, or will I hire a property manager?

Having clear objectives will streamline your decision-making process later on.

Step 2: Research the Market

Thorough market research is essential before making any real estate purchase. Start by identifying promising locations. Look for areas with strong economic growth, low unemployment rates, and increasing population numbers. A thriving job market often translates into high demand for rental properties.

Additionally, analyze local rental trends. What is the average rent in the area? Is there a high vacancy rate? Understanding these metrics will help you project potential income and expenses for the property.

Pro Tip: Tools like CoStar, Zillow, and Mashvisor can provide valuable market insights.

Step 3: Secure Financing

Apartment complexes can be substantial financial commitments, so securing the right financing is crucial. Here are a few options to consider:

- Traditional Bank Loans: Ideal for buyers with strong credit histories.

- Commercial Real Estate Loans: Specifically designed for larger investments like apartment complexes.

- Private Investors: If you aren’t ready to qualify for a loan on your own, consider partnering with private investors.

- Federal Housing Administration (FHA) Loans: There are programs for multi-family properties with up to four units if you plan to live in one of the units.

Make sure to get preapproved for a loan to strengthen your negotiating position when making an offer.

Step 4: Assemble a Team of Experts

Even if you're experienced in real estate, purchasing an apartment complex is a complex transaction that requires input from multiple professionals. Consider assembling a team that includes:

- A real estate agent specializing in multi-family properties.

- A real estate attorney to review contracts.

- A property inspector to assess the building’s condition.

- A financial advisor or accountant skilled in real estate investments.

Having the right experts on your side will help you avoid costly mistakes.

Step 5: Analyze Potential Properties

Once you've identified potential properties, evaluate their profitability thoroughly. Key factors to analyze include the following:

- Net Operating Income (NOI): Calculate the annual income minus operating expenses.

- Cap Rate: Divide the NOI by the property’s purchase price to understand its return on investment.

- Cash Flow: Subtract all expenses, including mortgage payments, from rental income to determine cash flow.

- Vacancy Rates: High vacancy rates may indicate challenges with tenant retention or pricing.

- Operating Expenses: Be aware of maintenance costs, taxes, insurance, and utilities.

Most importantly, perform a detailed property inspection to uncover any structural or maintenance issues that could lead to unforeseen expenses down the line.

Step 6: Make a Competitive Offer

When you’re ready to make an offer, lean on the expertise of your real estate agent and financial advisor to determine a competitive price. List your contingencies clearly, such as financing approval, satisfactory property inspections, and review of existing leases.

Remember, negotiation is key. Be prepared to negotiate for repairs, price reductions, or other concessions based on your due diligence findings.

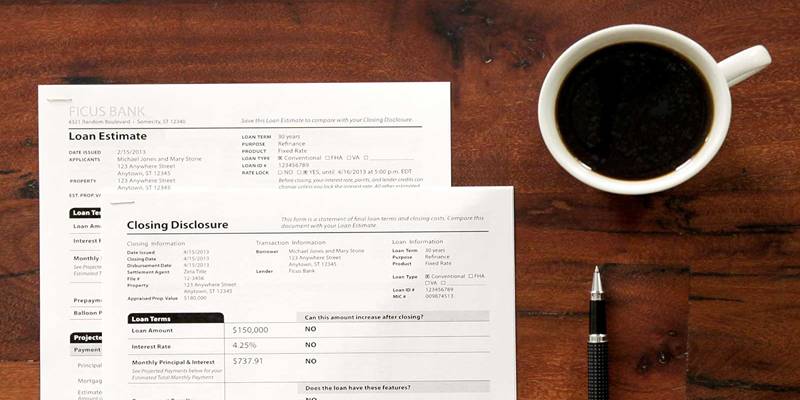

Step 7: Close the Deal

Once your offer is accepted, it’s time to finalize the purchase. During the closing process, you'll complete the following steps:

- Review Closing Documents: Carefully read every document with your attorney before signing.

- Secure Financing: Ensure your financing is finalized and the funds are ready.

- Transfer Ownership: Work with a title company to ensure the legal transfer of the property.

After the deal closes, transfer utilities, update insurance, and notify tenants once you're officially the new owner.

Conclusion

Purchasing a commercial property is a complex process that requires careful consideration and thorough due diligence. It's essential to work with experienced professionals, such as real estate agents, attorneys, and accountants, to ensure the transaction is successful. Conducting proper market research and thoroughly evaluating the potential return on investment is crucial in making an informed decision. And finally, during the closing process, it's vital to review all documents carefully and secure financing before transferring ownership officially.