Retirement isn't just about leaving work; it's about stepping into a new phase of life on your terms. Some dream of retiring early to travel, while others prefer to work longer for financial security or personal fulfillment. But how do you know when the time is right? The best age to retire isn't a one-size-fits-all number—it depends on your savings, health, and lifestyle goals.

Whether you're aiming for freedom at 55 or staying in the game until 70, understanding the key factors for making this choice will enable you to retire in peace and comfort. So, what's your ideal time?

The Role of Financial Planning in Deciding Retirement Age

Determining the best age to retire largely depends on financial planning. A strong financial foundation is essential for a comfortable retirement, ensuring you can sustain your lifestyle without financial stress. This involves assessing income sources, estimating future expenses, and building sufficient savings to cover your needs.

One major rule advised by financial analysts is to save sufficient to replace at least 80% of your pre-retirement income. This might look challenging, but it will avoid the danger of outliving your retirement savings. The sooner you plan, the more prosperous you will be when you retire.

Investments are also important to ensure a secure retirement. Consistent contributions to retirement funds like 401(k)s, IRAs, or pension plans can greatly improve your financial security. Knowing how the investments accumulate and when to take them out tactically is key in determining your retirement schedule.

For the self-employed or those without employer-sponsored coverage, consulting with a financial advisor can produce a savings plan that meets one's needs. Putting off retirement on account of poor savings can be anxiety-provoking, and therefore, early financial planning is critical. The optimal retirement age is when your fiscal security meets your preferred lifestyle so that you may retire on your terms without sacrificing your financial health.

Health and Lifestyle Considerations for Retirement

Health and lifestyle play a crucial role in determining the right time to retire. While financial stability is essential, your physical and mental well-being can influence whether early or delayed retirement is the better choice. Some people continue working to stay mentally and physically active, while others may opt for early retirement due to health concerns or the desire for a more relaxed lifestyle.

Health is a key factor in deciding when to retire. If you face medical issues or want to prioritize wellness, stepping away from work earlier may be ideal. Conversely, if you are in good health and enjoy your job, postponing retirement can provide additional financial security while keeping you engaged.

Lifestyle preferences also matter. Retirement can be a time to travel, pursue hobbies, or spend quality time with loved ones. However, these activities require financial planning to sustain your desired standard of living. A fixed retirement income must account for expenses, including unexpected healthcare costs and long-term care.

Planning ahead is essential to retiring comfortably. Estimating healthcare expenses, preparing for potential disabilities, and ensuring sufficient savings can help you transition smoothly into retirement while maintaining a fulfilling and active lifestyle.

Social Security and Pension Benefits

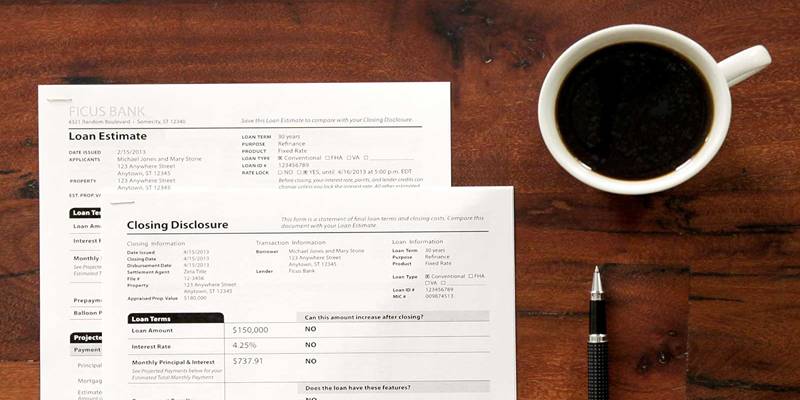

For many people, Social Security and pension benefits are key components of their retirement plan. These benefits provide a guaranteed income stream in retirement, but the age at which you begin collecting them can significantly impact how much you receive.

In the United States, the full retirement age for Social Security is typically 66 or 67, depending on the year you were born. However, you can choose to start receiving benefits as early as age 62, although this will result in a reduced monthly benefit. On the other hand, if you wait until after your full retirement age, your benefits will increase, potentially providing more financial security in later years.

Pensions, which are less common these days but still exist in some industries, work similarly in that they offer guaranteed payments over time. If you have a pension, it’s essential to understand when you can start receiving these benefits and how much you will receive based on your work history. This could be a major factor in determining the best age to retire.

Retirement savings plans like 401(k)s and IRAs are additional sources of income, but they don't provide guaranteed monthly payments like Social Security and pensions. These types of savings are subject to market fluctuations, so it’s important to monitor your portfolio and understand how your investments are performing as you approach retirement.

The Psychological Aspect of Retirement

Retirement isn’t just a financial or health decision—it’s a major psychological shift. Many people find that leaving behind decades of work can lead to feelings of loss, isolation, or a diminished sense of purpose. Without the daily structure and identity that a career provides, adjusting to retired life can be challenging.

On the other hand, retirement can be liberating, offering freedom from workplace stress and more time for personal fulfillment. However, mental preparation is key. Having a plan for how to spend your time—whether through hobbies, volunteering, or social activities—can make the transition smoother.

Younger retirees may enjoy a longer retirement, but adapting to a new routine takes effort. The key is to start thinking about post-retirement life early, ensuring you have both financial security and a clear vision of how you’ll spend your time, keeping yourself engaged, active, and fulfilled.

Conclusion

The best age to retire is a personal decision influenced by finances, health, and life goals. While many retire at 65, some do so earlier if financially prepared, while others work longer for added security. There’s no universal answer, but early planning is key. A solid financial strategy, awareness of health needs, and a clear post-retirement vision help ensure a smooth transition. By considering these factors and seeking financial guidance, you can retire at the right time for a secure, fulfilling life.