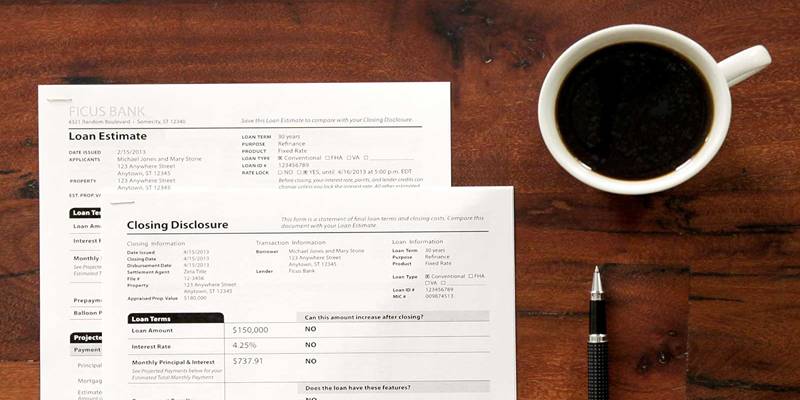

For most individuals, purchasing a home is one of the largest financial decisions they will ever make. Amid the emotions, paperwork, and planning, it’s easy for key details to get overlooked—especially when it comes to the financial side of the homebuying journey. That’s why two critical documents, the Loan Estimate (LE) and Closing Disclosure (CD), exist to safeguard consumers and ensure clarity and transparency in the mortgage process.

These documents serve as legal milestones that bookend the loan process: one at the start, providing an estimate of the loan terms and costs; the other at the end, confirming the final details before the borrower commits. Understanding what these documents mean and when they must be supplied is essential for any homebuyer or refinancer.

Loan Estimate

The Loan Estimate, often abbreviated as LE, is a standardized, three-page document designed to help consumers understand the potential costs associated with a mortgage. Mandated by federal law under the TILA-RESPA Integrated Disclosure Rule (TRID), the LE promotes transparency and allows borrowers to compare different loan offers side-by-side.

It outlines key loan terms, projected payments, and closing costs, giving borrowers a clear picture of what they can expect. By simplifying complex financial information, the LE empowers buyers to make informed decisions with confidence.

When Should the Loan Estimate Be Provided?

A lender is legally obligated to provide the Loan Estimate within three business days of receiving a complete loan application. These include the borrower’s full name, income, Social Security Number (which allows the lender to obtain a credit report), the address of the property in question, the estimated value of that property, and the amount the borrower wishes to finance.

Once all of this information is submitted, the lender must ensure the Loan Estimate is delivered within the required timeframe, giving the borrower a clear, early understanding of the proposed mortgage terms.

What Does the Loan Estimate Include?

The Loan Estimate offers a detailed overview of the proposed mortgage terms. It includes:

- Loan Amount: The total principal being borrowed.

- Interest Rate: Whether fixed or adjustable, this defines how much interest the borrower will pay over time.

- Monthly Principal and Interest Payment: A breakdown of monthly obligations.

- Estimated Taxes, Insurance, and Assessments: Projected costs that could be held in escrow.

- Total Closing Costs: The anticipated fees to complete the transaction.

- Estimated Cash to Close: How much the borrower will need to bring to the table at closing?

One of the most important indicators of the LE is the rate lock status. If the rate is not locked, it could fluctuate before closing, leaving the borrower vulnerable to market changes. However, if the rate is locked, the lender is typically bound to honor the terms—unless a valid change of circumstance occurs, such as a revised property value, lock extension, or credit status adjustment. In such cases, a revised Loan Estimate may be issued.

Closing Disclosure

As the home loan process nears completion, borrowers receive a second essential document: the Closing Disclosure (CD). This five-page form is the final summary of the mortgage terms, presenting the exact figures the borrower will be committing to when they sign. It provides a detailed breakdown of the loan amount, interest rate, monthly payments, and closing costs. By reviewing the CD, borrowers can ensure everything aligns with their expectations before moving forward with the final transaction.

When Should the Closing Disclosure Be Provided?

By law, the Closing Disclosure must be delivered at least three business days before the scheduled loan closing. This grace period is not optional—it exists so the borrower has time to carefully review the terms, ask questions, and identify any discrepancies from the initial Loan Estimate.

This rule also prevents borrowers from being rushed into signing on the spot without understanding the true costs of their mortgage.

What’s Inside the Closing Disclosure?

The CD mirrors the structure of the LE but replaces estimates with final numbers. It includes:

- Final Loan Amount and Interest Rate

- Monthly Payment (including escrow items like taxes and insurance)

- Total Closing Costs (broken into lender, third-party, and prepaid charges)

- Cash to Close (the actual amount needed at the closing table)

- Transaction Summary (all credits and debits for buyer and seller)

Unlike the Loan Estimate, which offers a forward-looking projection, the CD is the finalized agreement. Any changes from the LE must fall within government-regulated tolerance limits—which means lenders can’t significantly inflate costs without justification.

The Relationship Between Loan Estimate and Closing Disclosure

The LE and CD are designed to work in tandem. The LE sets the expectations; the CD confirms the outcome. The idea is that there should be little to no surprises when the borrower receives the CD, assuming no material changes occurred during the loan process. Together, these documents provide a clear roadmap from loan application to closing. This process ensures transparency, protects the borrower’s interests, and promotes informed financial decisions.

If the loan’s terms or costs have changed, the CD must clearly indicate what has changed and why. This transparency is a major step forward from the pre-2015 days when loan documents were often opaque and overwhelming. It is also worth noting that borrowers may request a revised CD if they need more time to review changes or if new information becomes available prior to closing.

Conclusion

The Loan Estimate and Closing Disclosure aren’t just pieces of paper—they represent a consumer’s right to transparency, fairness, and informed decision-making. By standardizing mortgage disclosures, federal law ensures that homebuyers have a clear understanding of what they’re committing to—before they sign on the dotted line.

Together, the LE and CD form a narrative arc: from anticipation to confirmation. A well-informed borrower is less likely to encounter financial pitfalls and far more likely to enter homeownership with confidence and clarity.