Starting with stock investing might seem daunting, but it’s easier than most people think. You don’t need a finance degree or a large budget—just a basic understanding and the right approach. Thanks to online platforms, anyone can invest with minimal funds. The real challenge isn’t just buying stocks but knowing where to begin, avoiding costly mistakes, and building a strong foundation for long-term success.

This guide simplifies the process, breaking it down step by step so you can invest with confidence. Whether you're new to the market or refining your strategy, understanding the basics is key to smart investing.

Easy Steps to Buying Stocks

Buying stocks may seem complex, but breaking it down into simple steps makes the process much more manageable. Here’s how to get started:

Choosing the Right Brokerage

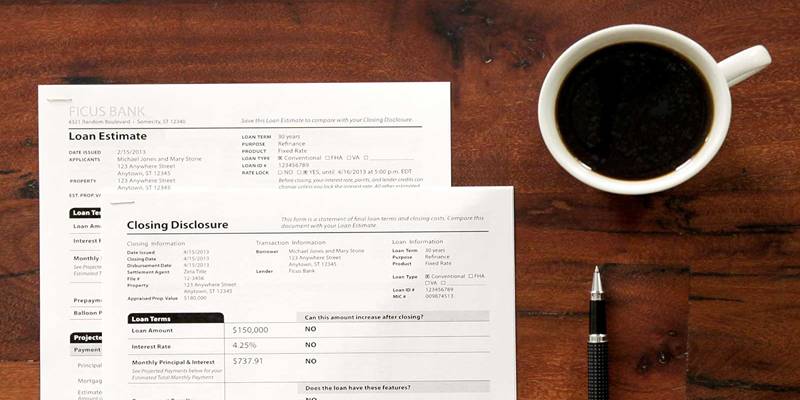

Before you can buy stocks, you require a brokerage account. This is the vehicle by which you make trades in stocks, just like a bank account facilitates financial transactions. There are numerous brokers out there, and they have varying fees, capabilities, and features. Some emphasize novice-friendly experiences, while others target experienced traders with sophisticated charting tools.

When choosing a brokerage, look at fees, minimum deposits, investment options, and customer service. Most brokers now have commission-free stock trading, which is less expensive to begin with. If you're just starting out investing, find platforms that offer learning tools and simple-to-use interfaces. After you've selected a broker, registering is easy. You'll need to present some form of identification, banking information, and personal finance data.

Funding Your Account and Setting Investment Goals

Once you have opened a brokerage account, the next thing to do is fund it. Most sites enable you to deposit funds through bank transfers, debit cards, or even wire transfers. Some brokers do not require you to make a minimum deposit, while others require an initial investment.

Before rushing into buying stocks, it’s important to define your investment goals. Are you looking for long-term growth, regular income from dividends, or short-term gains? Understanding your objectives will help shape your investment strategy. For beginners, a long-term approach is often the safest bet, as it allows investments to grow over time while minimizing the impact of market fluctuations.

Understanding Stocks and Market Research

Buying stocks isn’t just about picking a company you like. It’s about understanding how that company makes money, its potential for growth, and how it compares to competitors. This is where market research comes in.

Stocks represent ownership in a company. When you buy a share, you become a partial owner, meaning your investment is tied to that company’s success or failure. To make informed decisions, look at key financial indicators such as revenue, profit margins, and debt levels. Many investors also consider factors like industry trends, economic conditions, and the company’s competitive position.

Most brokers provide tools for researching stocks, including company profiles, earnings reports, and analyst ratings. You don’t need to analyze every detail, but having a basic understanding of a company’s health can help you make smarter investment choices.

Placing Your First Stock Order

Once you've chosen a stock, it's time to place an order. There are different types of stock orders, and understanding them will help you get the best price for your investment.

A market order buys the stock immediately at the current price. This is the simplest option and ensures your order is executed quickly. However, prices can change fast, especially in volatile markets.

A limit order allows you to set a price at which you’re willing to buy. If the stock reaches that price, your order will be executed. This gives you more control but may take longer to complete.

For beginners, market orders are often the easiest choice, especially for widely traded stocks. However, if you’re investing in smaller or more volatile stocks, limit orders can help you avoid overpaying.

Managing and Monitoring Your Investments

After buying your first stock, the journey doesn’t stop there. Investing in the stock market isn’t about buying and forgetting. Keeping track of your investments is essential for long-term success.

Review your portfolio regularly to see how your stocks are performing. Keep up with company news, earnings reports, and industry trends. While short-term price fluctuations are normal, significant changes may require adjustments to your strategy.

Diversification is also important. Instead of putting all your money into a single stock, spread your investments across different industries. This helps reduce risk and increases the chances of steady growth over time.

When to Sell Stocks

Knowing when to sell a stock is just as important as knowing when to buy. Some investors sell when they’ve made a significant profit, while others hold on for long-term gains.

There are a few key reasons to sell:

- The stock’s fundamentals have changed, and the company is no longer performing well.

- You’ve reached your financial goals and need to cash out.

- You find a better investment opportunity elsewhere.

Avoid making emotional decisions based on short-term market fluctuations. The stock market goes through ups and downs, but reacting too quickly can lead to unnecessary losses. Selling should be based on strategy rather than panic. Instead of focusing on short-term price changes, evaluate the company's overall performance and investment goals before making a decision.

Conclusion

Buying stocks step by step isn’t as complicated as it might seem. With the right brokerage, a clear investment goal, and some basic market research, anyone can start investing with confidence. The key is to stay informed, avoid impulsive decisions, and think long-term. Investing in the stock market can be a powerful way to grow wealth, but success comes from patience and smart decision-making. Whether you’re making your first purchase or looking to expand your portfolio, following these steps will help you build a solid foundation for your financial future.