People who are close to you may ask you to invest in their new business. It can be a good or bad thing. It might be fun to support a friend's business ideas, but making business choices while also taking into account personal relationships can be tricky. It's important to think carefully about whether to invest because the choice can have a big effect on both your finances and your friendship.

In the following sections, this post will explore how individuals can approach such a situation with professionalism, clarity, and careful planning to ensure they are making a well-informed decision that protects both their financial interests and their relationship.

Think Like a Professional, Not Just a Friend

When deciding whether to invest in a friend's business, the first thing you should do is look at it professionally, not just as a friend who wants to help. It means putting aside your feelings and looking at the business possibility with an open mind. People may be more likely to say yes because they have a personal connection, but the business's potential should be the main factor in a good investment.

To make a sound investment decision, treat the request like any other business opportunity. The first consideration is whether the business offers something unique. Does it solve a problem or meet a demand in the market? This evaluation is crucial to understanding the business’s potential for success.

Additionally, evaluate the friend’s qualifications and experience. Does your friend have the necessary skills and knowledge to make this venture successful? A great idea is not enough—execution is key. Asking these questions ensures that the decision is based on facts, not feelings.

Review the Business Plan in Detail

A solid business plan is essential to a successful venture. A well-prepared business plan signals that your friend has thought through the various aspects of the business. The business plan should include financial projections, market analysis, a strategy for growth, and an understanding of the competitive landscape.

The investor needs to ensure the business plan is realistic and detailed. It includes expected revenue, startup costs, profit margins, and future goals. Investors should also evaluate how the business plans to mitigate risks—whether that means handling supply chain issues, economic downturns, or competition. The more detail provided, the more confidence an investor can have in the business's potential.

Additionally, the business plan should address the return on investment (ROI) expectations and how the investor will be compensated, whether through equity or other means. Never invest without understanding how the business will generate profits and how long it will take before seeing a return.

Set Clear Boundaries Between Business and Friendship

One of the biggest challenges when investing in a friend's business is ensuring that clear boundaries are maintained between business dealings and personal relationships. Mixing business with friendship can lead to misunderstandings and conflicts. Setting ground rules from the beginning is crucial to keeping both the friendship and the business professional.

First, investors should discuss how business communications will be handled. For example, agree on specific times to discuss business matters rather than during social or family events. It helps keep personal relationships intact while focusing on the business.

Additionally, investors should be clear on their role in the business. Will they be a silent investor, or will they have a more active role in decision-making? Establishing these boundaries early on helps avoid conflicts and ensures both parties understand their respective roles.

Understand the Risks and Only Invest What Can Be Afforded

Investing in a startup or small business always carries inherent risks. Many businesses, particularly new ones, fail within the first few years. External factors like economic changes, supply chain disruptions, or customer demand fluctuations can derail a business.

As such, it is crucial that investors only commit money they can afford to lose. The business may not succeed, and the investor should be prepared for the possibility that the money invested might never be recovered. This is why it is important to carefully review personal finances and ensure that the investment does not jeopardize financial security.

Investors should not assume they will make a fortune by helping a friend. In fact, many startups take several years to turn a profit. By only investing in what is affordable, investors can protect themselves from financial strain if the business fails.

Consider Offering Non-Monetary Support Instead of Financial Investment

Money is not the only way to support a friend’s business. For individuals who may not have the financial resources to invest or are hesitant to take on financial risks, offering non-monetary support can be just as valuable. There are many ways to help a friend’s business without investing money.

For instance, the investor could offer expertise in areas such as marketing, social media management, or business development. Helping with event planning, promoting the business on social media, or providing advice on strategies for growth can be just as valuable as providing capital.

Make Sure Everything Is Documented

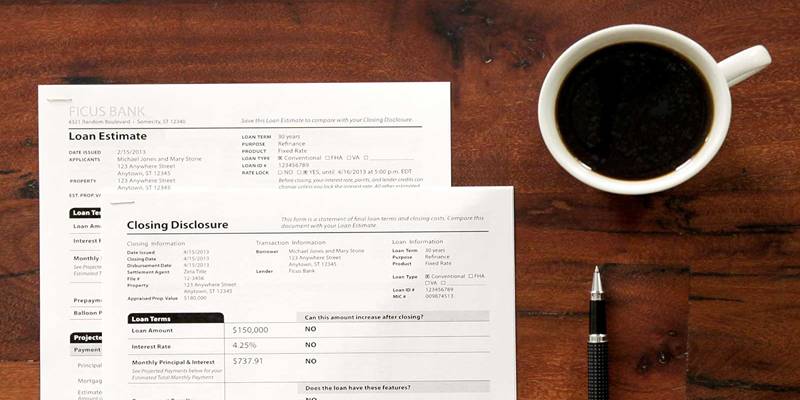

Even when investing in a business run by a close friend, everything should be formalized in writing. A handshake agreement, even with a lifelong friend, is never enough. Clear documentation reduces the risk of misunderstandings and ensures both parties are on the same page.

The terms of the investment—whether it’s a loan agreement or equity share—should be detailed in a contract. The agreement should specify how the investment will be repaid, the expected return, and what role the investor will play in the business. Formalizing the agreement ensures that both parties are protected and helps clarify expectations.

Conclusion

Investing in a friend’s business can be a rewarding experience, both personally and financially. However, it is a decision that should not be taken lightly. By approaching the situation with professionalism, reviewing the business plan thoroughly, setting clear boundaries, and ensuring all terms are documented, investors can protect both their financial interests and their friendships. It’s important to understand the risks involved, invest only what one can afford to lose, and consider offering non-monetary support if necessary.